Rationalisation of business registration with customs and the issuance of customs decisions and authorisations.

Who is concerned?

This document is intended for all natural and legal persons involved in international trade whose activities require a customs authorisation, decision or registration.

In summary

Before completing customs formalities, each operator must register with customs and obtain an EORI number (the EU's unique identification number). They may also apply for authorisations to benefit from certain facilitations: temporary storage to clear goods on their premises, simplified declaration for two-step clearance, etc.

There are two types of authorisations:

- authorisations listed in Annex A of Commission Delegated Regulation 2015/2446 of 28 July 2015;

- other national authorisations and approvals: e.g. national centralised clearance, authorised place of temporary storage (LADT) or "technical" approvals allowing a company to use customs IT systems.

The procedures for registering and issuing authorisations and approvals will change as part of the overhaul of customs information systems. The main changes are the switch of EORI registration to SIREN level and the exclusive use of the European platform "CDS" for Community authorisations.

An EORI number now linked to the company's registered office

Economic operators must have a unique EU identification number (EORI) in order to introduce or dispatch goods into or from the European Union or to file, modify and renew an application for the protection of their intellectual property rights (counterfeits). This registration can be obtained free of charge from the French customs. Today, in France, this registration is currently carried out at the level of the establishment (SIRET).

In the interests of simplification and harmonisation with the other Member States, EORI registration will soon be carried out at the level of the company's registered office (SIREN) and no longer at the level of each establishment. This change will bring two improvements for economic operators

- a limited number of EORI numbers for companies to manage, and

- the avoidance of deadlocks in other Member States’ customs clearance systems, which are based solely on the SIREN level.

Operators who do not have yet an EORI SIREN number should apply for one via the SOPRANO - EORI online service.

There will be a transitional period until the end of 2025, during which EORI SIRET will continue to be used. This three-year period will allow for the adaptation of the various online services using the EORI (in particular at the SIRET level) and, for operators, to obtain an EORI SIREN. From 1 January 2026, it will no longer be possible to carry out customs formalities in France using an EORI SIRET. A note to operators and a step-by-step guide will be publised shortly to explain this change.

Did you know?

AEO certified operators already have an EORI SIREN number and therefore do not need to re-register with Customs.

Customs authorisations issued exclusively via the European CDS system

The current situation

The procedures for issuing Community customs authorisations are not currently harmonised in France:

- some authorisations are issued in the European Customs Decision System (CDS): for example, the Community centralised customs clearance or regular shipping lines,

- others are issued via the French Customs system, SOPRANO,

- finally, others are not yet dematerialised: for example, the simplified declaration.

Towards issuing all Community authorisations in the European CDS system:

The objective is that, in the future, the 22 authorisations listed in Annex A will be applied for and granted through a single system: CDS. SOPRANO will continue to be used only for national authorisations and approvals (e.g. authorised places for temporary storage).

CDS will allow for the application of both single Member State authorisations (which are exclusively French) and cross-border authorisations (which are relevant to more than one EU Member State).

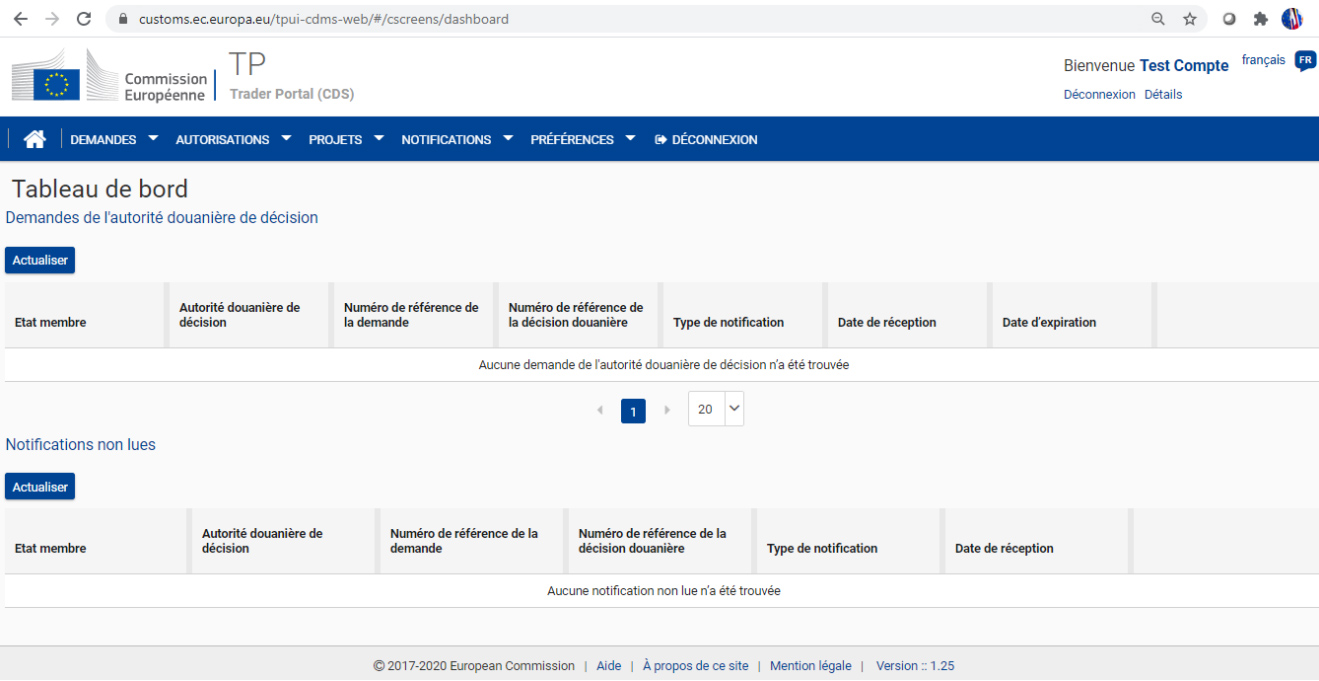

Did you say CDS?

CDS is the European Customs Decision System. It brings together two applications related to two different portals, one for operators: CDS-TP (trader portal/trader interface) and the other for customs offices: CDMS (management/customs services interface). A CRS database (repository or directory) allows the customs service to consult all the information relating to the authorisations issued via CDS.

The data required are those defined in Annex A of the UCC delegated and implementing acts.

Applications for special schemes are the first authorisations to be transferred to CDS. The other types of authorisations will be transferred gradually. French Customs will inform operators by means of a notice, before each changeover.

What will happen to existing authorisations?

Authorisations issued before the switchover to CDS will remain valid.

What is the timetable?

It is possible to obtain an EORI number for one's registered office since 5 April 2023. Companies will have until 31 December 2025 to re-register.

The transfer of authorisations to the European CDS tool will be done on an authorisation-by-authorisation basis. Applications for special procedures have been integrated into CDS between 20 March and 25 April 2023, applications for customs value adjustments (CVA-AJ) have been effective since 17 April 2023.

See the information on this procedure on the French customs website (in French): Specific rules apply for the Value Adjustment Authorisation (VAA).

For further information

Like any new IT tool, CDS requires a period of familiarisation and learning. French Customs has published a "Guide for economic operators using the European Customs Decision Portal - TP-CDS" [PDF]. A fact sheet on CDS [PDF] and numerous links are available on the DGGDI website.

To facilitate the transition, the Commission has put tutorials online. Operators can familiarise themselves with this application by consulting the online training modules on :

- The EU Customs Trader Portal[elearning module]

- The Customs Decision System CDS[elearning module]

Ask your CRSP, your registered customs representative, your trade association or specialised training organisations in customs-related matters for assistance in your preparation.

The Business Consultancy Unit (Pôle d’Action Economique) of your regional customs directorate is also at your disposal to provide you with any additional information on these developments in the area of authorisation management. It will explain the practical consequences for your business and how you can prepare for these changes.

- EU identification number (EORI)

- SOPRANO - EORI online service

- Specific rules apply for the Value Adjustment Authorisation (VAA)

- Guide for economic operators using the European Customs Decision Portal - TP-CD…

- Fact sheet on CDS

- Numerous links on TP-CDS

- The EU Customs Trader Portal [elearning module]

- The Customs Decision System CDS [elearning module]

- The Business Consultancy Unit

- Understanding and preparing for the import-export overhaul